Camden entrepreneur shares lessons on financial literacy with children

Financial literacy is a subject that isn’t covered enough in many traditional secondary institutions and rarely at all in schools with younger attendees. Topics such as mortgages, taxes, and credit aren’t typically discussed.

If children aren’t introduced to money management practices at home or venture out on their own to educate themselves, many rarely have any knowledge in the area until they’ve reached adulthood.

Ieshia Smith, CEO and founder of MDCT Credit Solutions, which stands for Making Dreams Come True, decided to combat this issue in Wilcox County by making finances easier to digest for children in schools where financial literacy isn’t a part of the curriculum.

She writes children’s books specifically about money management and visits local schools and youth organizations, using her work to initiate the conversation about responsible financing.

“This is something that the youth desperately need. Knowing these things is extremely important and can make a huge difference in how they view finances going forward in life,” Smith said. “We weren’t taught this in school—many of us weren’t—and I can definitely see how that made an impact in our lives.”

The idea came from her 9-year-old daughter, Malena, who frequently likes to pretend that she’s her mother, helping clients and running her own business.

“She will ask ‘Mom, what’s a credit card? Mom, what is credit? How does that work?’” Smith said.

“And I realized I needed to find some way to break this information down into a way that she could actually understand it, which got me thinking that ‘you know what, it would be cool if someone would write a book specifically to teach parents how to talk to their kids about finances. And things just sprouted from there.”

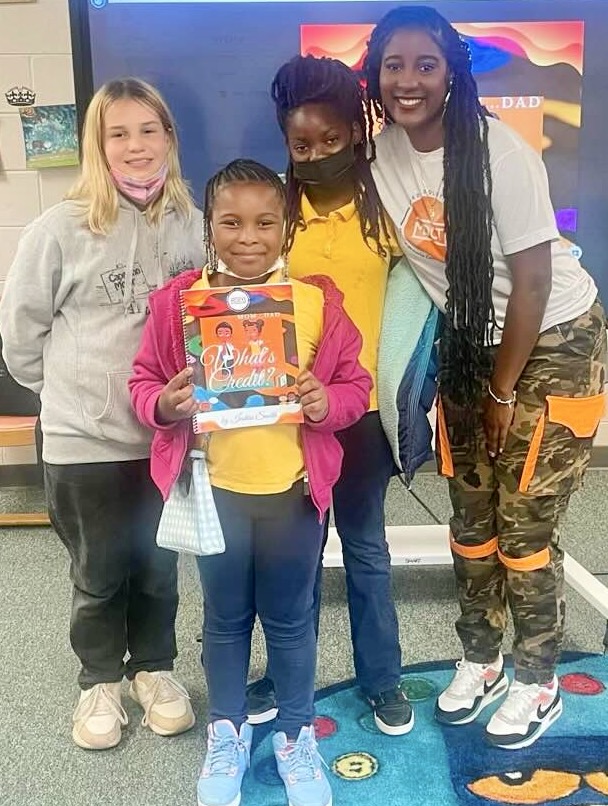

In her book “Mom… Dad… What’s Credit?,” featuring Lala the credit expert, her twin brother, MJ, and her little sister, Lena, characters based on her two young daughters and kid brother, Smith discusses the importance of creditworthiness, budgeting and investing, educating children on how to go about building and maintaining credit, having financial goals and saving to achieve them.

Smith also has a few helpful tips for parents. Those include tips such as issuing allowances using debit cards, which helps kids get acquainted early with card usage and suggesting kid-friendly stocks to introduce them to stock investing.

Her work also includes chore charts, budgeting worksheets, some credit-related puzzles, and coloring sheets to finish the book.

“I knew it was going to be influential when I was working on the cover of the book and my daughter—who had no idea I was working on it at the time—stopped in her tracks at the sight of it. She was so enthused by just the cover that she instantly asked, ‘Mom what’s that book? I want to read that book!’” Smith recalled.

“What was really encouraging was after we read the book together, her best friend had come over, and Lena told her basically everything from the book, cover to cover, and she understood. The fact that she retained that information just from the one read and both girls could comprehend the concepts was amazing to see. It was then that I realized ‘Wait, this actually works!’”

Soon after, she began the process of getting her books printed, which, with a help of a dear friend and a chance encounter, led to an opportunity for her to extend the reach of her new creation to other children besides Lena and her friend.

Smith’s friend, Rayshell White, who owns a print shop, jumped at the opportunity to help her print the book for broader distribution.

After the book was printed, the next step came when she had a conversation with Stephanie Williams, the gifted specialist for the Wilcox County School District. Williams invited her to visit local schools to read the books to school children.

“We ended up going on this crazy, beautiful book tour. And it was just amazing,” Smith said. Smith and Williams traveled to the three public schools in Wilcox County, J. E. Hobbs, F. S. Irvin, and ABC Elementary, sharing with the children lessons on budgeting and money management.

Williams said, “I had wanted to introduce financial literacy to my students for a while now. I knew Ieshia [Smith] was a credit consultant in our community but hadn’t known about her book until I saw her one day at the print shop,” Williams said. “So, I proposed the idea and we got to work.”

She added, “The children had never had an open forum where they could talk freely about saving money or those things before, but their time spent with Ieshia sparked lots of productive conversations about these matters. The information they’ve been made privy to at such a young age—looking back on my childhood, and even as an adult, I wish I had had access to that knowledge.”

The tour went so well that Wilcox County Superintendent Dr. Andre’ Saulsberry approached Smith to speak to seniors at Wilcox Central High School, a week before their graduation, about credit, finances, and everything they need to be aware of as budding adults.

Smith discussed how to build credit but forewarned them of the difficulty of repairing credit after it’s been damaged, a discussion usually only had once it’s too late.

“I wanted to instill in them some guidance before they go off to college and start getting these credit card offers, not realizing the impact that misusing these cards could have on their credit. It’s such a hassle to clean up your credit afterward, and I want to spare them that, to reach them before that point,” she said.

Because of the success of the book tour and the children's positive reaction to the information Smith provided, the Wilcox County School System will be buying her books and implementing them into the public school’s curriculum this upcoming school year.

“We plan to introduce the books to the elementary schools in the fall,” Debra Turk, Federal and Special Program Specialists for the Board of Education, said. “Dr. Saulsberry and I decided that her work would make a fantastic addition to the schools. This is information that we felt the kids needed to know.”

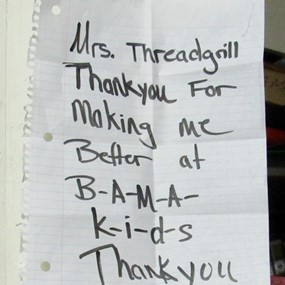

In addition to local schools, Smith has also spoken to the 4-H Youth Council members at the Wilcox County Alabama Extension office, and her books can be found in the hands of the children in the BAMA Kids program.

She’s now settling back into her primary position as an entrepreneur and credit consultant and continues to “make dreams come true” one person at a time by providing her clients with the most efficient avenues in achieving creditworthiness.

“‘Making dreams come true’—I realize that sounds a bit corny, but that’s what I aspire to do. I know I can’t actually ‘make dreams come true’ just by helping people with their credit, but I can be a vehicle to get them from a rejection letter to financing whatever their dreams may be. For example, getting a loan for their dream house or funding for that business idea they may have.”

Within Wilcox County and beyond, she’s doing just that, according to client testimonials. Cindy, a client from Mississippi, stated, “I’ve been with MDCT for a few months, and I’ve already begun to see progress. She’s guided me from start to finish with my credit. She truly is the credit G.O.A.T (greatest of all time)."

Smith admits that starting her business was not always easy. She had times that made her reconsider her ability to achieve her own goals, much less those of her clients. However, with the support of family and friends, she was able to continue to grow, learning lessons every step of the way.

She said, “After everything, I’ve learned that having a business is not about the money—it can’t be. You’ll drive yourself crazy with desires routed solely in money. If you focus on genuinely helping people and doing right by others, you’ll be more fulfilled. And success will come without asking.”

Tags: Camden